These are the steps you follow when applying for KRA iTax tax compliance certificate online using the ITax System in the KRA iTax Login portal

How to Apply for KRA Tax Compliance Certificate – TCC Online

-

Visit the KRA iTax website https://itax.kra.go.ke/KRA-Portal/

-

Login to your KRA account by typing your KRA iTax pin number, password and the security stamp

-

Click on ‘Certificates’ tab then select ‘Apply for Tax Compliance Certificate (TCC)’

-

On the new window type the reason why you are applying for the TCC and click ‘Submit’

-

You will be taken to a new window written ‘Application for tax compliance certificate has been submitted successfully’. You will be prompted to download the acknowledgement receipt for the Tax Compliance Certificate.

-

At the bottom of the downloaded acknowledgement receipt you will be told

Note: Dear Taxpayer, your application for Tax Compliance Certificate has been received by us through KRA front desk. This application will be forwarded to the concerned area officer for further processing. Please follow the instructions given in the email and produce necessary documents.

So access your email after a few days -

After the few days wait you may receive a regret written “Rejection of Application for Tax Compliance Certificate”

Don’t Panic, you can contact KRA using these contacts KRA Call Centre

1. Tel:+254 (020) 4999 999+254 (020) 4998 000

2. Cell: +254 (0711) 099 999

3. Email: callcentre@kra.go.ke

4. Follow us on Twitter at https://twitter.com/KRACustomerCare

5. Like the KRA Customer Care Facebook page at https://www.facebook.com/kra -

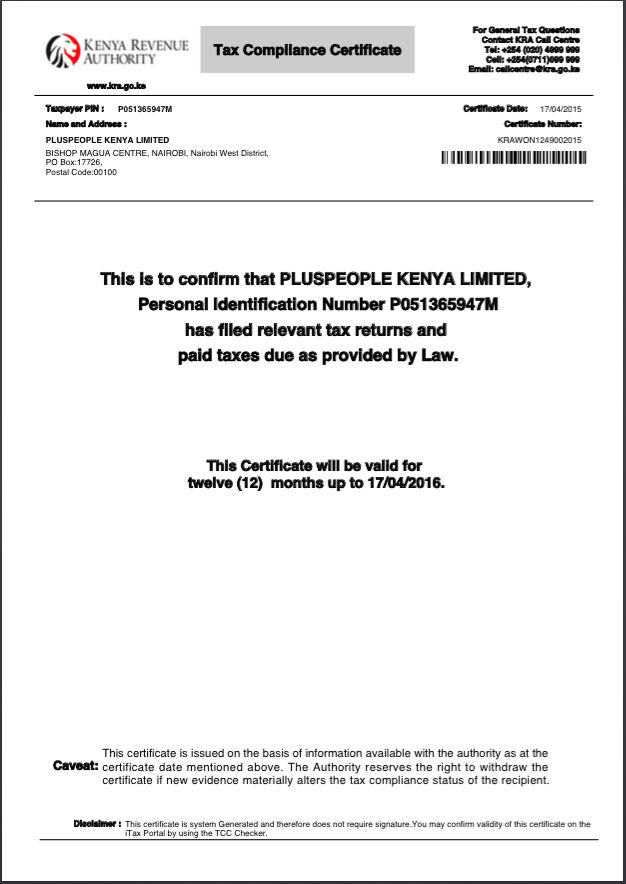

Or you can receive another email with an approval one as below. The email will come with your Tax Compliance Certificate attached to it. Download it and print it. The certificate will look like this

Watch the video tutorial below of How to apply for KRA iTax compliance certificate – TCC

How to apply for KRA tax compliance certificate – TCC