Currently, all students are required to go online for their HELB Application Exercise. The links below will help the students navigate around the HELB Application Portal and find any information concerning HELB loan

These loans are for students joining public or private universities within the East African Community directly from high school either through the KUCCPS or as self-sponsored.

Amounts awarded range between 35,000 minimum and 60,000 maximum based on the level of need.

For the students placed by KUCCPS, the loan is split to cater for both Upkeep and Tuition fees. Ksh. 4,000 is deducted per semester as tuition fee for the Government-sponsored students and the rest is sent to the applicant’s bank account as upkeep. A total of Ksh 8, 000 per year is deducted for tuition fees.

For the Self-sponsored students, all the money is sent directly to the university once a year as tuition fees.

There is an Administrative Fee of Ksh 500 that is charged per year on the loan awarded and it is deducted from the disbursed loan.

The very needy government-sponsored students are considered and receive a bursary of between Ksh 4, 000 and Ksh. 8,000 per year, which is paid to the university as tuition.

Students are advised to apply at least one month before the opening date to allow ample time for processing and remittance. The application period is January through July every year.

Management of HELB loans

The loan attracts the interest of 4% p.a and the students are required to repay their loans on completion of their studies.

Students are advised that the loans should be used mainly for:

- Tuition,

- Books and stationery,

- Accommodation and subsistence

Students are advised to desist from diverting the funds to leisure or other family obligations.

How to apply for a HELB Loan as a First Time Applicant

👉Access the HELB Student Portal and click on “create an account” to register.

👉Once you create the account, log in and pick the Undergraduate First Time Loan Application Form you want.

👉You can read the literature or view the videos on Financial Literacy then participate in the online brief exercise.

👉Access and fill the loan application form.

👉It is mandatory that you print TWO copies of the Loan Application Form you have filled.

👉Take the two forms you have printed to the relevant authorities for stamping.

👉Organize well all the documents as per the checklist and present one copy of the filled and signed Loan Application Form at the HELB Student Service Centre on Mezzanine 1, Anniversary Towers, University Way, Nairobi or at any of the following Huduma centers nearest to you for free and secure delivery.

- Bomet

- Bungoma

- Chuka

- Eldoret

- Embu

- Garissa

- Nairobi GPO

- Kakamega

- Kericho

- Kilifi

- Kisii

- Kisumu

- Kitale

- Kitui

- Lodwar

- Machakos

- Makueni

- Meru

- Migori

- Mombasa

- Murang’a

- Nakuru

- Nandi

- Narok

- Nyeri

- Taita Taveta

- Thika

- West Pokot

👉It is also mandatory that you retain a complete copy of the Loan Application Form

Requirements

👉One recent colored passport size photograph of the applicant.

👉Copies of the parents’ National ID Cards/death certificate where the parent is deceased

👉Copies of both guarantors’ National ID Card

👉A copy of the applicant’s Smart Card from the institution

👉A copy of the Applicant’s national ID Card

👉A copy of the applicant’s Bank ATM/Bank card (for Government-sponsored students only)

👉A copy of the applicant’s admission letter and KCSE result slip/certificate

How to apply on the HELB App as a second and Subsequent applicant

👉The student should first download the HELB Mobile Application from the Google play store.

👉In the Helb App, register your details (First name, Phone, Email Address, National ID and KRA PIN number)

👉This will generate a PIN which you will use to log in

👉Accept the license agreement.

👉Make sure you use your Safaricom Number (That the Mpesa and Safaricom account is registered in your name)

👉Read and understand the mandatory Financial literacy notes and do the Question & Answer.

👉Scroll to the bottom to view results then click “proceed”.

👉Click on loans then select undergraduate loans to get the Undergraduate Subsequent Loan Application Form.

👉Follow the step carefully while filling in the required details then click submit.

👉A message will pop-up and the loan serial number displayed to indicate that you have successfully applied for the loan.

👉Ksh. 1 will be charged from your mpesa account when verifying your telephone number.

Those students who are not Safaricom subscribers will be directed to the Helb Portal to apply using the application form. After filling the form they will print and submit it to the HELB Student Service Centre on Mezzanine 1 Floor at Anniversary Towers.

Loan Application Forms for self-sponsored students

All HELB Loan applications for self-sponsored students are done online from this online form found HERE

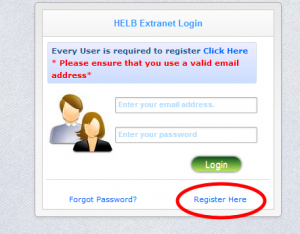

How to Create a HELB Portal Account

Step 1: Visit our website www.helb.co.ke

Step 2: Click on “Apply for a Loan”

Step 3: Click “Register Here” to register your credentials (First Name, Middle Name, Last Name, *ID Number, *Valid Email Address, Password) and Click “Sign Up”

Step 4: An *Activation Link is immediately sent to your personal email address.

Step 5: Login to your personal email address to access the HELB Portal *activation link and click on it.

Step 6: Login to the HELB Portal from the activation link

Step 7: Update Personal and Residence Details and Click “Save”

Step 8: Choose an Appropriate Loan Product to Apply.

Watch this video tutorial of HELB Loan Application via the Student Portal

HELB Bursary Application Forms

Click on THIS LINK to access the HELB Bursary Application forms.

Tvet Loan and Bursary Application Form

The Higher Education Loans Board awards loans and bursaries to students pursuing Diploma and Certificate courses in Public Universities, Colleges and Public National polytechnics in Kenya

Students pursuing Diploma and Certificate courses in Public universities, university colleges, public national polytechnics and Institutes of Technology and Technical Training institutes country-wide are eligible for this loan and bursary.

Orphans, single parent students and others who come from poor backgrounds will be given priority for the loans and or bursaries. The application period is January to April every year.

To apply for HELB TVET Loan and Bursary Click HERE

HELB Afya Elimu Fund Loans – FUNZO Loans

The Higher Education Loans Board – HELB, entered into partnership with Intra Health Kenya with a view to enhancing access and equity to higher education specifically to health workers by way of granting them loans and scholarships.

The Loans and scholarships target those already within the health sector workforce as well as those directly enrolled into approved institutions mandated in the training of health workers. The objectives of the program are:

👉To increase the production of new health workers in Kenya.

👉Promote quality and efficiency in the delivery of health care.

👉To increase the pool of experts in different and specialized health fields.

👉Motivate and improve retention of health workers.

For HELB Afya Elimu Fund Loans conditions Click HERE

Training Revolving Fund – TRF

HELB Training Revolving Fund was introduced as part of the efforts by the Government of Kenya to assist Public Servants access funds at subsidized interest rates for training in order to enhance knowledge and skills considered critical for performance improvement and achievement of National development goals.

The product is administered by the Higher Education Loans Board in partnership with the Ministry of State for Public Service and was introduced in the year 2011/2012.

For HELB Training Revolving Fund Loan conditions Click HERE